Challenges and threats facing the FinTech sector in Spain

The FinTech sector provides great opportunities and has strong potential but changes are required such as more information for the general public, a reduction in the number of the barriers and processes to entrepreneurship, the promotion of professional training and overcoming managerial resistance in order to transform the way finances are managed. These are the main findings of the study Challenges and threats facing the FinTech sector in Spain. The perspective of the current and future professional which was presented today in Barcelona.

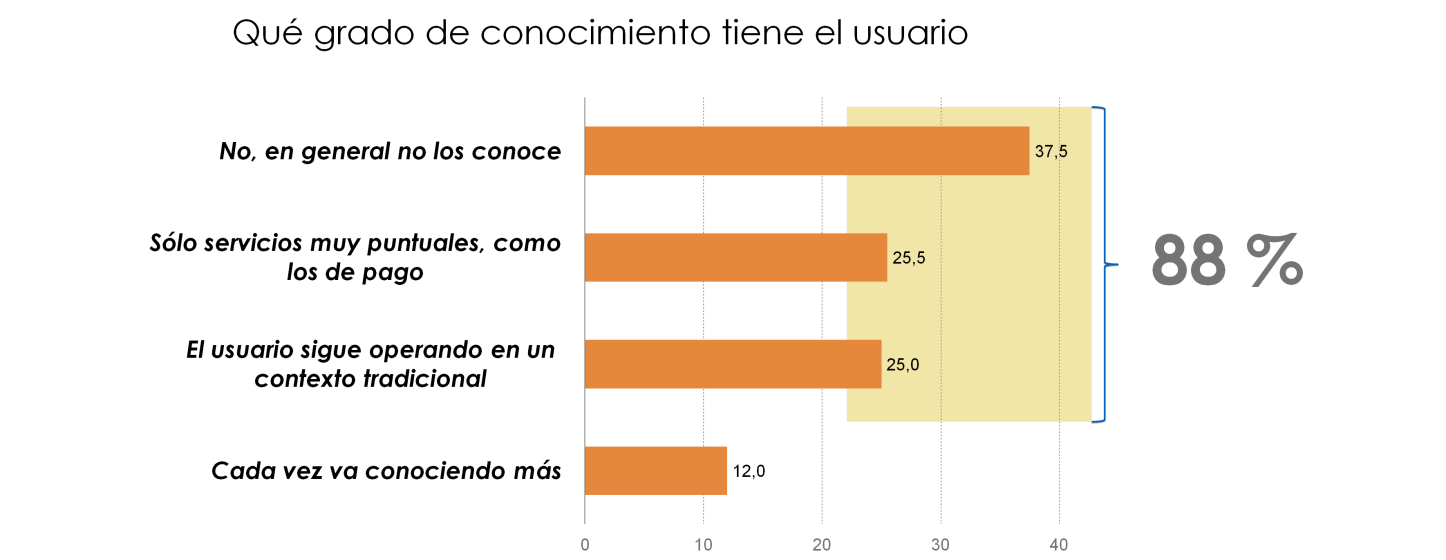

The study, which was compiled by EADA Business School in collaboration with ISDI, surveyed the opinions of more than 300 active professionals in the financial industry. 88% of those surveyed consider users to be lacking in knowledge and largely locked into the traditional format of banking and financial services. However, the vast majority of professionals - almost 70% - have high expectations for growth in the FinTech sector.

According to Joan Torras, co-author of the study, professor of Finance at EADA Business School and author of the book ‘The new digital revolution, cryptocurrency and Blockchain’ “although the degree of knowledge of the sector is, in general, still low, this does not prevent it from growing dramatically over the next few years. In fact, the degree of penetration of FinTechs in the day-to-day lives of professionals is higher than they perceive and many are already incorporating Fintechs, such as Paypal, in their normal operations”.

90% of respondents said they need to acquire more knowledge in the main technological area of verticals and tools as well as soft skills. According to Raushan Kretzschmar, Director of the Master in FinTech & Business Analytics EADA-ISDI and co-author of the study, in the context of profound transformation in the financial services sector and the implementation of a more efficient FinTech sector, “companies must commit to training and qualifying their current and future professionals”.

More than 50% of respondents consider that private investors and multinationals are more committed to the development of FinTech than the Public Administration (governments, Autonomous regions and local entities).